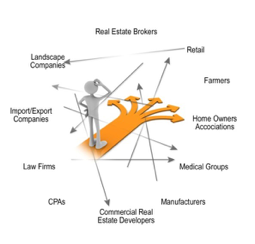

What Would Happen To The Growth of Your Bank If Real Estate Brokers and CPAs Stopped Feeding Your Lenders Deals?

After 17 years and over 100 banks as clients, my partner Lisa and I continue to review dozens and dozens of lender marketing plans every year. 95% of these marketing plans have a section in them that reads as follows:

After 17 years and over 100 banks as clients, my partner Lisa and I continue to review dozens and dozens of lender marketing plans every year. 95% of these marketing plans have a section in them that reads as follows:

Referral Sources

Focus on those who can refer quality deals such as:

- CPAs (With a few names listed)

- Real Estate Brokers (With a few more names listed)

- Attorneys (More names listed)

- Insurance Brokers (More Names Listed)

Now, there is absolutely nothing wrong with cultivating referrals sources. We all like referrals. The problem is lenders have become too reliant on the actions of others for deal flow. Furthermore, the business development strategies utilized by your lenders earlier in their careers to develop new business have gotten dull and in-effective. This one factor, being overly reliant on third party referral sources, is one of the biggest (but not the only) reasons approximately 50% of all lenders fail to hit their annual sales goals.

Fantastic! Your In-bound Marketing Efforts are Working…Sort Of!

“In-bound” marketing efforts are defined as the opportunities your network feeds you. The deal flow from traditional COIs is the by-product of developing relationships with professional colleagues in your market.

We’ve worked with and coached many savvy lenders who have cultivated extraordinary relationships with extremely well-connected centers of influence (COIs). These lenders are the envy of all the other lenders in your bank because of the quality and quantity of deal flow that their COIs provide. These lenders produce, $15M to $20M or more like clockwork every year and the bulk of those deals usually come from four or five high profile, well-connected COIs. These lenders should be congratulated because they have done a fantastic job identifying and developing mutually satisfying relationships with quality professionals who have a client base that matches well with their bank’s credit appetite and ideal customer profile. This didn’t just happen. It was developed over years.

The problem is this isn’t the way it works for most lenders. For the majority of lenders, their “COIs” are a collection of professional colleagues and acquaintances most of whom have very diverse clientele. Every lender has a few high quality COIs and then a number of COIs that are less ideal. Because of that, the referrals these COIs provide are also a hodge-podge array of opportunities. The consequences of having to sift through this mixed bag of referrals include:

- Wasted time and energy meeting with poor quality prospects

- Wasted internal resources when lenders work on, spread and submit marginal deals

- Working on deals that are too small or are marginally profitable

- Frustration when our efforts don’t convert to closed deals

- Embarrassment of having to turn down the prospect and then, having to tell your COI of the news

- Not hitting sales goals as a result of investing too much time on low to poor quality prospects

- Not receiving an annual bonus because of poor production

But What About Your Out-bound Marketing Efforts?

“Out-bound” marketing efforts are defined as the new business opportunities your lenders create directly with the owners and senior executives of targeted companies in your market.

“Out-bound” marketing efforts are defined as the new business opportunities your lenders create directly with the owners and senior executives of targeted companies in your market.

The majority of banks that we’ve worked with over the past 17 years have utilized varying types of out-bound marketing such as being an event sponsor, sponsoring a booth at an industry trade show or annual conference or advertising in a trade publication. But that’s usually where most of a bank’s out-bound marketing efforts end. There exists no choreographed, highly focused out-bound marketing where the bank’s marketing efforts and the sales efforts of lenders are working in unison to build market share.

This isn’t a discussion of good or bad, meaning referrals are bad and creating your own new business opportunities is good. This is a discussion of how to make your bank’s out-bound business development efforts more productive, strategic and focused.

The business landscape continues to change, yet lenders continue to approach today’s rapidly evolving market with business development and sales strategies used for the past twenty to thirty years. Most of us are not driving a car built in 1987 because technology and safety features have advanced significantly in the past thirty years. Why as an industry would we rely so heavily on the outdated sales approached utilized well over thirty years ago?

How Does A Lender Produce $3.5M in 2015 and $10.5M By July 2016?

This is just one of dozens of real life examples where we’ve helped lenders become much more productive. This is what can happen when a lender learns how to work smart, “play to their strengths” and apply more contemporary marketing and differentiation strategies. Working harder gets you incremental productivity gains. Working smarter gets you exponential gains in productivity. Gains in productivity aren’t difficult to achieve provided you look at your market and your sales efforts with a different set of lenses. There is nothing more valuable than the value of a “fresh perspective” to create viable new opportunities.

The biggest impediment to helping lenders and sales managers become more productive is their outdated thinking. Nearly every lender in every State targets real estate brokers and CPAs as their primary source of deal flow. How unoriginal! The second impediment to improving lender productivity are senior executives don’t see the value in developing the single biggest asset any company has…its employees. Talk about outdated thinking given today’s war for talent. Your employees and the manner in which they advise your customers is the only thing that differentiates your bank from the twenty five other banks competing in your market.

Ready to Hone Your Out-Bound Business Development Efforts?

For 17 years, Lisa and I have been dedicated to rebuilding the reputation of the banking industry, one banker at a time and one conversation at a time. We enjoy sharing contemporary ideas, resources and tools that are consistent with today’s help bankers to perform better.

Help your lenders get a strong start by [wp_colorbox_media url=”#inline_content” type=”inline” hyperlink=”downloading my newest ebook”], Taking An Evolutionary Approach To Lender Marketing Plans – Leading Edge Strategies For Sharpening Lender Production.

It’s only 16 pages, but packed with modern insights, exercises and fresh perspectives designed to help lenders and their sales managers to work smarter and to learn how to become more productive.

If you’d like to discuss your bank’s current out-bound marketing efforts, please call me at 760-720-9270 or email me at ray@btigrowthadvisors.com

Lisa and I wish you much success in 2017!

Happy New Year!

Ray Adler

CEO & President

BTI Growth Advisors, Inc.

760-720-9270

BtiGrowthAdvisors.com

SalesHoningAcademy.com

If you look at the trends impacting the banking industry, one can’t deny that the banker is quickly becoming an unnecessary component in the attainment of a commercial loan.

If you look at the trends impacting the banking industry, one can’t deny that the banker is quickly becoming an unnecessary component in the attainment of a commercial loan.

Einstein said “you can’t solve a problem with

Einstein said “you can’t solve a problem with

Oliver Wendell Holmes said, “A moment’s insight is sometimes worth a life’s experience.”

Oliver Wendell Holmes said, “A moment’s insight is sometimes worth a life’s experience.”